Coinbase, one of the largest cryptocurrency exchanges in the world, is facing significant backlash after it decided to delist Wrapped Bitcoin (wBTC). The exchange cited concerns about Justin Sun, the founder of Tron, as the primary reason for the delisting, sparking sharp criticism from the crypto community and a legal challenge from BiT Global.

“Unacceptable Risk” or Guilt by Association?

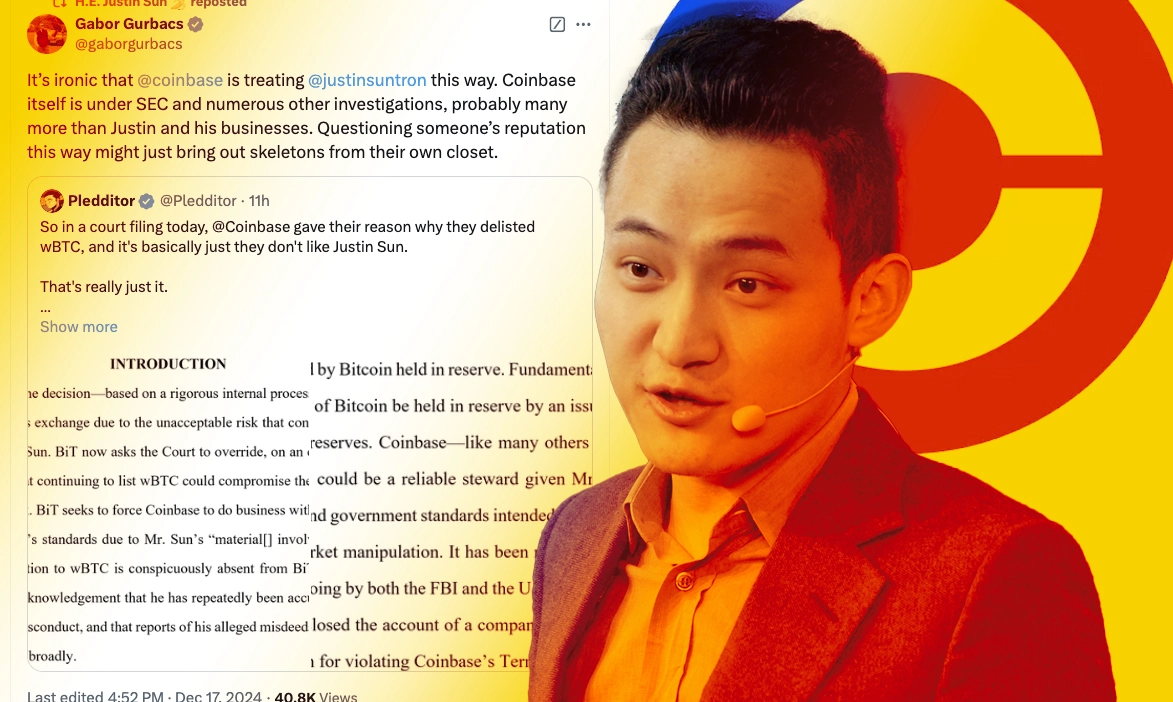

In its filing on December 17, Coinbase attributed the delisting of wBTC to the “unacceptable risk” posed by Justin Sun’s affiliation with the token. The exchange highlighted allegations of financial misconduct and ongoing regulatory investigations involving Sun.

“At the conclusion of its diligence, Coinbase concluded that Mr. Sun’s affiliation with—and potential control over—wBTC presented an unacceptable risk to its customers and the integrity of its exchange,” the filing stated.

However, this rationale has drawn ire from industry insiders, who argue that Coinbase failed to provide any technical or legal justification for the move. Critics, such as the notable crypto commentator Pledditor, have dismissed the explanation as “guilt by association,” questioning the objectivity of the decision.

BiT Global’s Legal Challenge

BiT Global, a prominent player in the cryptocurrency space, filed a lawsuit against Coinbase on December 13. The firm claims that the delisting of wBTC is not only unjustified but also illegal. According to BiT Global, the decision:

- Damages Market Integrity: The delisting has allegedly harmed the Wrapped Bitcoin market, causing economic disruptions.

- Breaches Antitrust Laws: BiT Global accuses Coinbase of trying to monopolize the tokenized Bitcoin market by promoting its own product, cbBTC, at the expense of competitors like wBTC.

The lawsuit also took aim at Coinbase’s inconsistency, criticizing the exchange for continuing to list tokens with arguably less credibility, such as meme coins.

The Irony: Coinbase’s Own Legal Troubles

Critics have pointed out the irony of Coinbase targeting Sun for his regulatory challenges while the exchange itself is under intense scrutiny.

- SEC Lawsuit: Coinbase is currently facing charges from the U.S. Securities and Exchange Commission (SEC) for allegedly offering unregistered securities.

- Compliance Settlement: In January 2023, Coinbase agreed to pay $100 million to the New York Department of Financial Services over deficiencies in its compliance program.

Gabor Gurbacs, an advisor at VanEck, remarked on the irony, stating, “Coinbase itself is under SEC and numerous other investigations, probably many more than Justin and his businesses. Questioning someone’s reputation this way might just bring out skeletons from their own closet.”

Justin Sun’s Regulatory Troubles

Justin Sun, a prominent figure in the crypto world, is no stranger to controversy. The SEC has accused Sun of fraud and selling unregistered securities, allegations that have cast a shadow over his various ventures. Coinbase’s decision to delist wBTC appears to stem from these regulatory challenges, but the move has raised questions about the objectivity and transparency of the exchange’s delisting process.

Sun has yet to respond directly to these current allegations but has previously maintained his innocence regarding the SEC charges.

Market Reactions and Community Backlash

The crypto community has reacted strongly to Coinbase’s decision, with many questioning the exchange’s motives. Wrapped Bitcoin is a widely used asset in decentralized finance (DeFi), serving as a bridge between Bitcoin and Ethereum-based applications. Its delisting by one of the industry’s leading exchanges could have significant implications for the broader market.

Critics argue that Coinbase’s decision could destabilize the wBTC ecosystem, discouraging institutional and retail investors from participating in tokenized Bitcoin markets.

Wrapped Bitcoin’s Role in the Crypto Ecosystem

Wrapped Bitcoin (wBTC) is a tokenized version of Bitcoin that operates on the Ethereum blockchain. It allows Bitcoin holders to participate in DeFi applications without selling their Bitcoin holdings.

- Liquidity: wBTC provides liquidity to DeFi platforms, enabling users to earn yields or access decentralized loans.

- Interoperability: By bridging Bitcoin and Ethereum, wBTC fosters greater integration between the two ecosystems.

The delisting of wBTC has raised concerns about its future adoption and utility, particularly if other exchanges follow suit.

Potential Implications for Coinbase

Coinbase’s decision to delist wBTC could have broader implications for its reputation and market position.

- Loss of Trust: By failing to provide a robust justification for its actions, Coinbase risks alienating its user base.

- Legal and Financial Risks: The lawsuit from BiT Global could result in financial penalties or regulatory action against Coinbase.

- Market Competition: The controversy could create opportunities for rival exchanges to attract disenchanted wBTC users.

Looking Ahead: The Battle for Transparency

The controversy surrounding the decision to delist wBTC underscores the need for greater transparency and accountability in the cryptocurrency industry. As regulatory scrutiny intensifies, exchanges must strike a delicate balance between ensuring compliance and maintaining the trust of their users.

For the company, the ongoing legal and public relations challenges present an opportunity to reevaluate its policies and practices. Whether the exchange can navigate this storm without lasting damage to its reputation remains to be seen.