Cango Inc., a Chinese automotive services company trading on the New York Stock Exchange (NYSE), has made a striking yet under-the-radar entry into the cryptocurrency mining industry. The company recently emerged as one of the largest public Bitcoin miners globally, thanks to strategic acquisitions and a calculated pivot from its traditional automotive focus.

Massive Bitcoin Mining Expansion

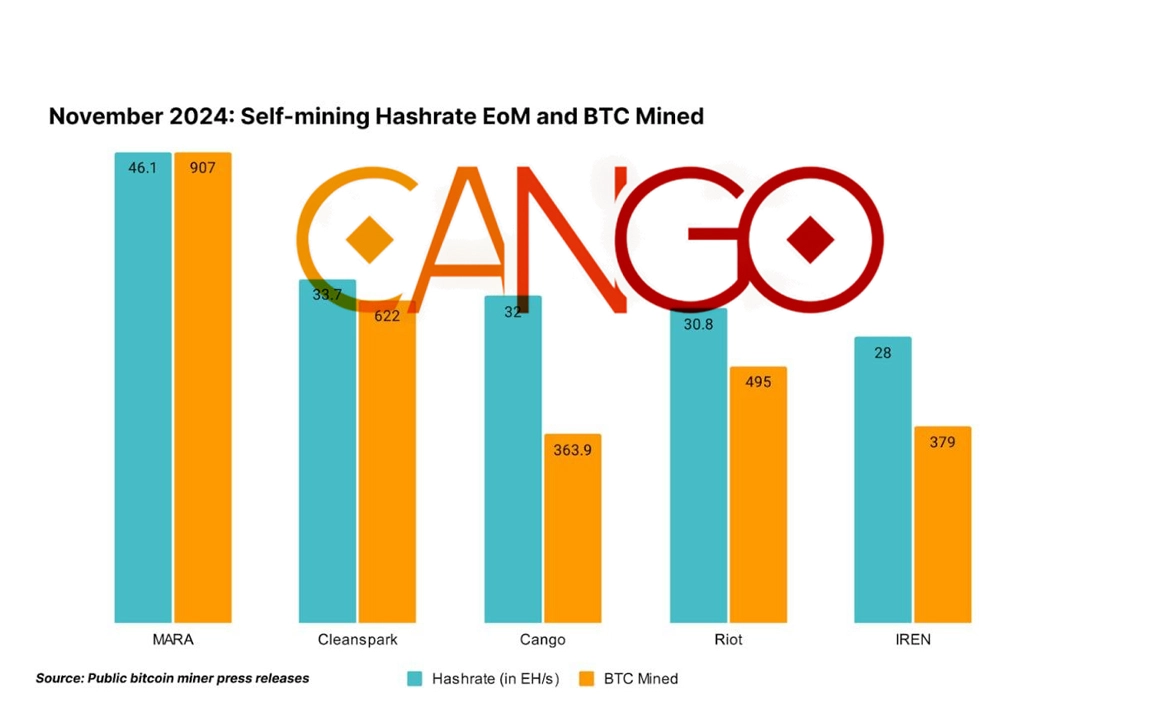

According to a November 15 press release, Cango purchased 32 EH/s (exahashes per second) of Antminer ASICs from Bitmain for $256 million in cash. This acquisition represents roughly 4% of Bitcoin’s global network hashrate. Additionally, the company has another 18 EH/s under contract with Golden TechGen Limited, a company fully owned by Bitmain’s former CFO, Max Hua.

Should the second deal close as planned by March 31, 2025, Cango’s mining capacity would reach an astounding 50 EH/s. This would position the company alongside industry leader Marathon Digital Holdings (MARA) in self-mining hashrate.

Strategic Partnerships with Bitmain and Golden TechGen

Cango’s mining operations are deeply intertwined with Bitmain, the world’s largest producer of cryptocurrency mining hardware. The 32 EH/s fleet is hosted at Bitmain-operated facilities in the United States under an 18-month service agreement. These facilities, including a significant presence in Georgia, provide hosting and operational support.

The second deal with Golden TechGen Limited, valued at $144 million in stock, would expand Cango’s mining footprint further. As part of the agreement, Max Hua, owner of Golden TechGen, will gain the right to appoint two members to Cango’s board, provided his ownership stake exceeds 5%.

Financials and Market Performance

Cango’s market capitalization has soared in response to its mining endeavors, reaching $500 million. As of December 17, its shares were up 54% week-over-week and a staggering 584% year-to-date.

The company reported $3.8 million in revenue for Q3 2024 and mined 363.9 BTC in November, valued at approximately $38.76 million at current prices. These earnings, coupled with a total outstanding financing transaction balance of $685.7 million, underline the growing role of Bitcoin mining in Cango’s financial strategy.

Cutting-Edge Mining Technology

Cango’s initial mining fleet consists entirely of Antminer S19 XPs, one of the most advanced Bitcoin mining rigs available. The acquisition price of $256 million translates to $8 per terahash, aligning with market rates for bulk orders. This move demonstrates Cango’s commitment to leveraging cutting-edge technology to maximize efficiency and profitability.

The timing of this purchase is notable, as it coincides with regulatory challenges for Bitmain. The U.S. Customs and Border Protection Agency recently detained shipments of Bitmain’s new S21 and T21 models at ports of entry. To mitigate such risks, Bitmain has begun assembling S21 units in a newly opened U.S. manufacturing facility.

The Shift from Automotive Services to Cryptocurrency Mining

Cango’s foray into Bitcoin mining marks a significant pivot from its roots in automotive services. Traditionally focused on financing transactions within the automotive industry, the company appears to be diversifying its operations in response to evolving market conditions.

This strategic diversification aligns with a broader trend of non-crypto companies entering the Bitcoin mining space, seeking to capitalize on its lucrative potential.

Challenges and Opportunities

Despite its impressive strides, Cango faces several challenges:

- Regulatory Risks: Hosting a significant portion of its mining fleet in the United States exposes Cango to regulatory uncertainties, particularly amid heightened scrutiny of cryptocurrency activities.

- Integration with Automotive Services: Balancing its traditional business with the demands of large-scale Bitcoin mining may present operational and strategic hurdles.

- Market Volatility: Bitcoin price fluctuations could impact the profitability of mining operations.

However, the opportunities are equally significant. By integrating cryptocurrency mining into its portfolio, Cango positions itself to benefit from the growing adoption of digital assets and blockchain technology.

Implications for the Mining Industry

Cango’s rise to become the third-largest public Bitcoin miner underscores the rapidly changing dynamics of the mining sector. The company’s entry brings new competition to established players like Marathon Digital and Riot Blockchain, potentially driving innovation and efficiency across the industry.

Moreover, Cango’s strategy highlights the increasing institutionalization of Bitcoin mining. With its NYSE listing and significant capital investments, the company exemplifies how traditional enterprises can successfully navigate the crypto landscape.

Future Outlook

Looking ahead, Cango’s expansion plans hinge on the successful closure of the Golden TechGen deal and the effective integration of its mining operations with its broader business strategy.

As the company continues to grow its Bitcoin mining capacity, it may also face greater scrutiny from investors and regulators. How Cango balances these pressures with its ambitious goals will determine its long-term success in both the cryptocurrency and automotive sectors.