In a groundbreaking move to enhance trust in institutional cryptocurrency adoption, Web3 security firm Cyvers has partnered with Station70 to launch Secure Signers, an industrial-grade transaction security solution. Designed to address a $4 billion vulnerability in crypto systems, this tool promises to fortify institutional crypto transfers and pave the way for broader adoption of decentralized finance (DeFi) solutions by traditional finance (TradFi) players.

This initiative comes amid a dramatic rise in cyberattacks targeting centralized platforms and wallets, underscoring the urgent need for robust security mechanisms in the digital asset space.

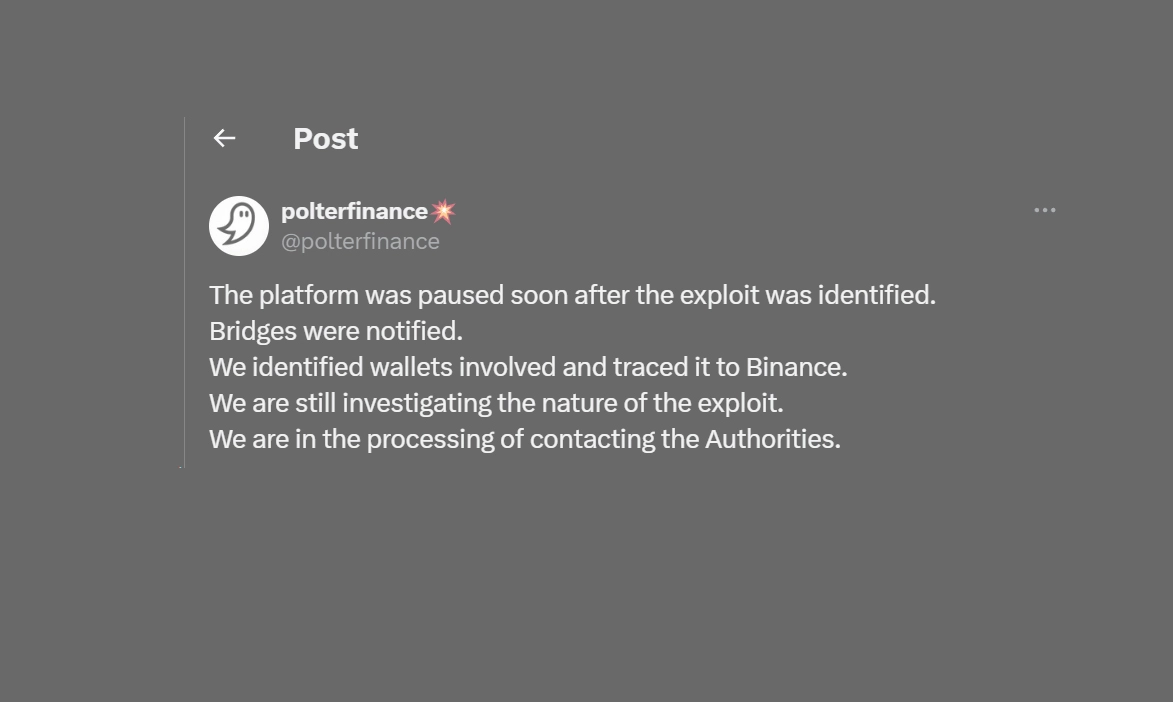

Also read: Polter Finance Halts Operations After $12M Flash Loan Hack

A New Era for Institutional Crypto Security

Secure Signers combines Cyvers’ real-time threat detection technology with Station70’s co-signer-as-a-service system, offering a sophisticated solution for safeguarding institutional cryptocurrency transactions.

The tool, tailored for institutional clients using platforms like Fireblocks wallets, proactively simulates and validates transactions for potential security risks before they are executed on the blockchain. This approach aims to eliminate vulnerabilities that hackers often exploit in large-scale operations.

The $4 Billion Problem: Rising Threats in Web3 Security

Cyvers reports that access control vulnerabilities have cost the Web3 ecosystem $4 billion in losses over the past three years. In 2024 alone, cyberattacks targeting centralized crypto entities surged by over 1,000%, with high-profile breaches such as:

- BTCTurk Hack: Resulting in $54 million in losses.

- BingX Hack: Costing $52 million.

These incidents highlight the fragility of existing security frameworks, especially when handling institutional-grade transactions.

“The recent spate of attacks showcases the pressing need for advanced transaction signing systems,” said Cyvers CEO Deddy Lavid.

How Secure Signers Works

Secure Signers leverages cutting-edge AI-powered algorithms to monitor and intercept threats in real-time. By integrating these capabilities with Station70’s co-signer-as-a-service platform, the tool offers:

- Proactive Transaction Validation: Identifies and mitigates risks before blockchain execution.

- Seamless TradFi Integration: Simplifies adoption by aligning with traditional financial workflows.

- Enhanced Real-Time Security: Detects anomalies and intercepts threats as they occur.

This functionality makes Secure Signers particularly appealing to TradFi institutions, many of which have hesitated to invest in crypto due to concerns over security vulnerabilities.

Bridging the Gap Between TradFi and Crypto

One of the most significant barriers to institutional adoption of cryptocurrency has been the lack of trust in the security of digital assets. Secure Signers aims to address this by solving operational and security challenges that have hindered TradFi participation.

“By bridging the gap between traditional finance and decentralized systems, Secure Signers accelerates Web3 adoption,” said Lavid.

The solution offers an enticing prospect for institutions, combining robust security measures with streamlined integration into existing financial systems.

AI’s Role in Revolutionizing Crypto Security

Artificial intelligence is at the core of Cyvers’ mission to safeguard the crypto ecosystem. The company’s algorithms have already demonstrated their efficacy in preventing cyberattacks.

- Case in Point: Cyvers detected a fraudulent smart contract linked to the $230 million WazirX hack eight days before the attack occurred, according to Michael Pearl, Cyvers’ VP of GTM strategy.

- This predictive capability showcases the potential of AI to revolutionize security in a rapidly evolving industry.

The AI-driven approach of Secure Signers is designed to provide institutions with unparalleled confidence in their crypto transactions, further reducing the risks associated with digital asset adoption.

The Bigger Picture: Mass Adoption of Web3

Secure Signers’ launch reflects a growing recognition of the importance of institutional participation in the Web3 ecosystem. By addressing the security vulnerabilities that have plagued the crypto industry, Cyvers and Station70 are laying the groundwork for broader adoption.

Key Benefits of Institutional Adoption:

- Increased Liquidity: Institutions bring significant capital, boosting market stability.

- Enhanced Credibility: Institutional involvement lends legitimacy to the crypto space, attracting more participants.

- Accelerated Innovation: Greater resources drive technological advancements in DeFi and blockchain solutions.

Challenges Ahead

While Secure Signers represents a major leap forward, challenges remain.

- Evolving Threat Landscape: As security systems become more sophisticated, so do the methods employed by hackers. Continuous innovation will be crucial to staying ahead.

- Regulatory Uncertainty: The regulatory environment for crypto remains complex and fragmented, which could impact the adoption of tools like Secure Signers.

- Cost of Implementation: For smaller institutions, the cost of integrating advanced security solutions may pose a barrier.

Despite these hurdles, the potential benefits of Secure Signers far outweigh the challenges, making it a promising development for the industry.

What’s Next for Cyvers and Station70?

With Secure Signers, Cyvers and Station70 have set a new standard for institutional crypto security. Moving forward, their focus will likely include:

- Expanding partnerships with financial institutions to drive adoption.

- Enhancing AI capabilities to adapt to emerging threats.

- Advocating for regulatory frameworks that support innovation while ensuring security.

By prioritizing security and trust, the partnership between Cyvers and Station70 is poised to play a pivotal role in shaping the future of Web3.

A Turning Point for Crypto Security

The launch of Secure Signers marks a significant milestone in the evolution of cryptocurrency security. By addressing critical vulnerabilities and fostering trust among TradFi institutions, Cyvers and Station70 are not only mitigating risks but also driving the mass adoption of decentralized finance.

As the industry continues to mature, innovations like Secure Signers will be instrumental in bridging the gap between traditional and decentralized financial systems, ensuring a secure and sustainable future for the crypto ecosystem.