Donald Trump’s victory in the 2024 U.S. presidential election is creating waves in the cryptocurrency industry. According to Faryar Shirzad, Coinbase’s Chief Policy Officer, the combination of a Republican-controlled Congress and a pro-crypto president sets the stage for rapid advancements in U.S. crypto legislation.

Coinbase’s Shirzad predicts that the long-awaited regulatory clarity for digital assets and stablecoins could materialize as early as 2025, signaling a potential watershed moment for the 50 million Americans who own cryptocurrencies.

“Most Pro-Crypto Congress in History”

A Favorable Legislative Environment

Coinbase’s Shirzad, speaking at a U.K. event organized by the Coinbase-backed Stand With Crypto group, described the incoming Congress as “the most pro-crypto in history.” With the Republican Party securing control of the House, Senate, and White House, Shirzad expects legislative gridlocks on crypto issues to ease significantly.

Key legislative priorities include the Financial Innovation and Technology for the 21st Century Act and the Clarity for Payment Stablecoins Act:

- The Financial Innovation and Technology for the 21st Century Act:

This bill aims to create a legal framework for digital assets, ensuring clarity around their classification and use in the U.S. economy. - The Clarity for Payment Stablecoins Act:

Focused on regulating issuers of stablecoins—cryptocurrencies tied to fiat currencies—this bill seeks to establish licensing regimes to foster trust and stability in the market.

Shirzad is optimistic these bills will gain traction, though he acknowledges a “small” chance they will pass during the lame-duck session before Trump’s inauguration.

Crypto’s Growing Lobbying Power

Influence Through Funding and Advocacy

The cryptocurrency industry played a significant role in shaping the political landscape that led to Trump’s victory. Crypto-focused political action committees (PACs) and advocacy groups raised over $245 million during the 2024 election cycle, according to Federal Election Commission data.

The Coinbase-supported Stand With Crypto Alliance also created a grading system to evaluate lawmakers’ stances on cryptocurrency, helping pro-crypto candidates secure nearly 300 seats in Congress. This robust lobbying effort underscores the industry’s increasing political influence.

The Impact of SEC Leadership Changes

Gensler’s Departure Marks a New Era

One of the most notable changes on the horizon is the resignation of U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, effective January 20, 2025. Gensler, known for his aggressive stance on crypto oversight, frequently clashed with the industry during his tenure.

Trump’s administration is expected to appoint an SEC chair more aligned with his pro-crypto vision. While Shirzad refrained from speculating on specific candidates, he expressed confidence that Trump would select a “change agent” who prioritizes innovation and regulatory clarity.

This shift in leadership could have profound implications for how cryptocurrencies are regulated in the United States, potentially reducing enforcement actions and fostering a more collaborative environment.

Legislation Expected in 2025

What’s on the Horizon?

Even if immediate legislative action isn’t taken during the lame-duck session, Shirzad foresees “significant movement” in 2025. Both the market structure and stablecoin bills aim to address longstanding uncertainties that have hindered the industry’s growth in the U.S.

For instance, the Financial Innovation and Technology for the 21st Century Act could establish clear rules for determining whether a digital asset is classified as a security, commodity, or other financial instrument. Similarly, the Clarity for Payment Stablecoins Act would provide much-needed guidelines for stablecoin issuance and operation, fostering consumer trust and market stability.

The Industry’s Optimism and Concerns

Post-Election Euphoria

The cryptocurrency market has already begun to react positively to Trump’s win. Barclays’ Pascale highlighted a “post-election crypto euphoria” spreading across financial markets, reflecting optimism about the industry’s regulatory and growth prospects under a Trump administration.

Bitcoin and other cryptocurrencies have seen a surge in value since the election, with many investors anticipating a friendlier regulatory environment.

Balancing Innovation and Oversight

While the industry is optimistic, concerns remain about the balance between fostering innovation and implementing necessary safeguards. Clear and consistent regulations are vital to preventing fraud, protecting investors, and maintaining the integrity of financial markets.

Shirzad emphasized the importance of appointing regulators who understand the complexities of digital assets and are committed to creating a collaborative framework for the industry.

The Global Implications of U.S. Crypto Regulation

Setting a Precedent for Other Nations

As the world’s largest economy, U.S. crypto regulations have a significant impact on global markets. Clear guidelines from the U.S. could encourage other countries to adopt similar frameworks, fostering international cooperation and reducing regulatory fragmentation.

Attracting Innovation and Investment

A pro-crypto stance from the U.S. government could also make the country a more attractive destination for blockchain startups and investors. With many firms previously hesitant to operate in the U.S. due to regulatory uncertainty, the potential for clear rules may reverse this trend.

What’s Next for the Crypto Industry?

The cryptocurrency industry is at a crossroads, with Trump’s presidency offering a unique opportunity to establish regulatory clarity and unlock new growth potential. Key developments to watch include:

- Legislative Progress: Monitoring the advancement of the Financial Innovation and Technology for the 21st Century Act and the Clarity for Payment Stablecoins Act.

- SEC Leadership: Observing the impact of Trump’s SEC appointee on enforcement actions and regulatory policies.

- Market Response: Tracking how investors and companies react to the evolving regulatory landscape.

The next few years could prove pivotal in shaping the future of cryptocurrencies in the United States and beyond.

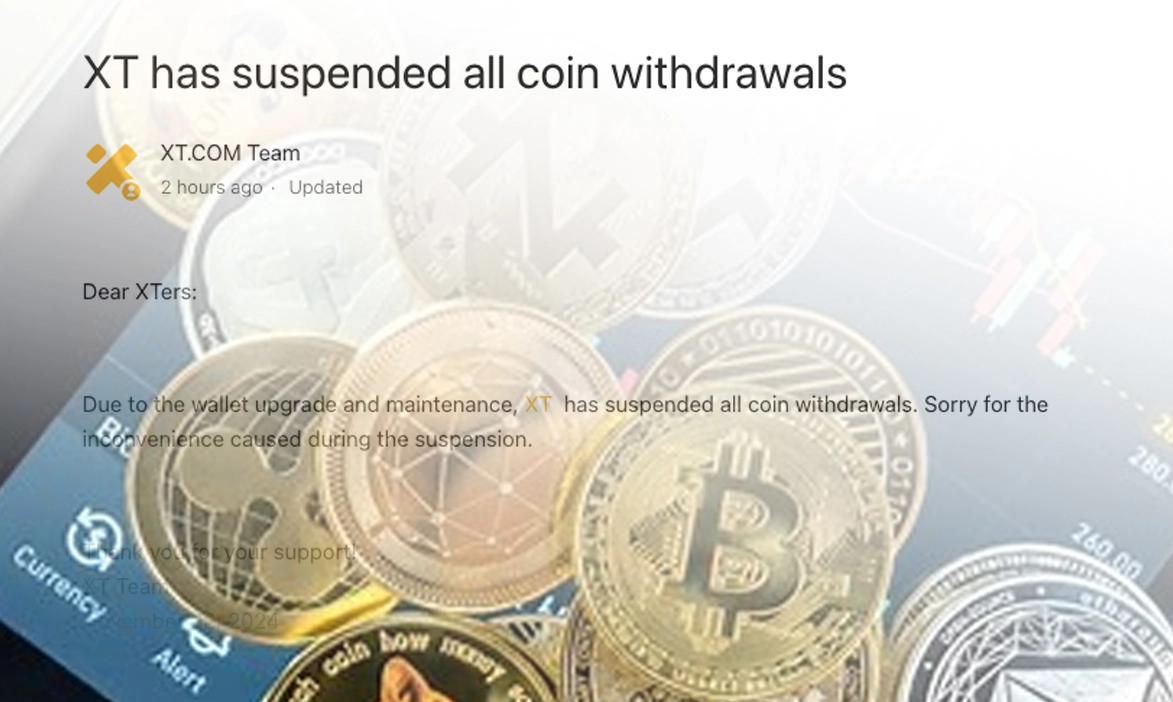

Also read: Polter Finance Halts Operations After $12M Flash Loan Hack