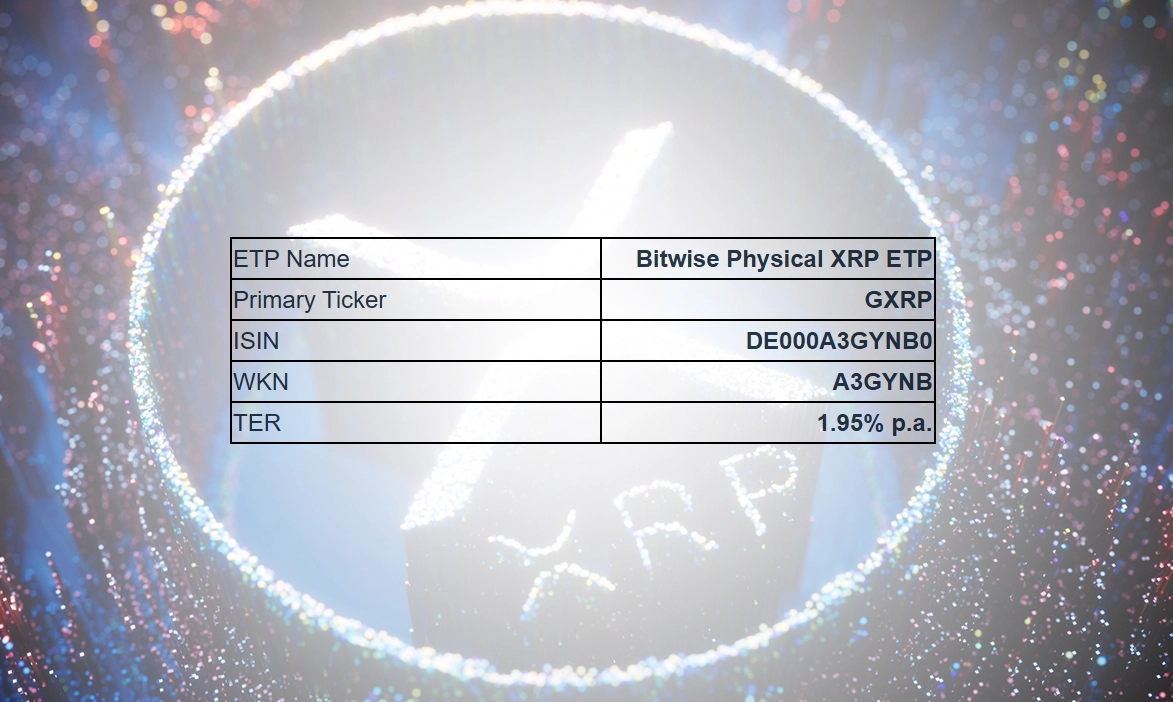

In a significant development for the cryptocurrency investment landscape, Bitwise Asset Management announced the rebranding of its European XRP exchange-traded product (ETP), now named the Bitwise Physical XRP ETP (ticker: GXRP). Ripple, the blockchain infrastructure giant behind XRP, revealed plans to invest in the newly branded product.

This move underscores the increasing demand for institutional-grade crypto offerings and highlights XRP’s pivotal role in the digital asset ecosystem, valued at over $80 billion in market capitalization.

Also read: Polter Finance Halts Operations After $12M Flash Loan Hack

Why the Rebranding Matters

The rebranding of the ETP, formerly known as the ETC Group Physical XRP ETP, aligns with Bitwise’s strategic focus on its European product suite.

- Enhanced Market Positioning: As part of the rebrand, Bitwise aims to fortify its presence in Europe by emphasizing institutional-quality crypto products.

- Strong Regulatory Backing: Issued under a prospectus approved by Germany’s BaFin (Federal Financial Supervisory Authority), the ETP provides secure, compliant exposure to XRP for European investors.

Hunter Horsley, CEO and Co-Founder of Bitwise, remarked, “XRP and the XRP Ledger are among the most familiar and trusted blockchains in crypto, with a 10-year track record of reliability. We’re thrilled to provide access through this institutional-quality product.”

Ripple’s Strategic Investment

Ripple’s decision to invest in the Bitwise Physical XRP ETP reflects its confidence in the product and the broader utility of XRP. CEO Brad Garlinghouse emphasized the growing appetite for crypto-backed investment vehicles, particularly as regulatory clarity in the U.S. has improved.

“As one of the most valuable, liquid, and utility-driven digital assets, XRP stands out as a cornerstone for those seeking access to assets that are resilient and have real-world utility,” Garlinghouse said.

Ripple’s support further solidifies XRP’s position as a key player in cross-border remittances, institutional DeFi applications, and real-world tokenization.

XRP: A Cornerstone of Crypto Innovation

XRP, the fifth-largest cryptocurrency by market cap, has seen a resurgence in popularity in 2024. This growth is driven by its expanding use cases on the XRP Ledger (XRPL), including:

- Cross-Border Payments: XRP’s speed and low transaction costs make it a favored choice for international remittances.

- Institutional DeFi: The XRPL is increasingly used for decentralized finance applications tailored for enterprises.

- Tokenization: Real-world assets like real estate and financial instruments are being tokenized on the XRPL, showcasing its versatility.

These developments have strengthened XRP’s reputation as a digital asset with tangible utility, distinguishing it from speculative tokens.

The Evolution of Bitwise in Europe

Bitwise has been making waves in Europe’s crypto investment scene, particularly after acquiring ETC Group in August 2024. This acquisition brought a diverse portfolio of crypto ETPs under Bitwise’s management, bolstering its presence in the region.

Key milestones include:

- Expanding Product Line: The Bitwise Aptos Staking ETP launched on the SIX Swiss Exchange on November 19, 2024.

- Upcoming U.S. Offerings: Bitwise recently filed a Form S-1 with the U.S. SEC for an XRP spot ETF, signaling its intent to dominate the institutional crypto market.

- $10 Billion Milestone: Bitwise surpassed $10 billion in total client assets this year, a testament to its growing influence.

Horsley highlighted Bitwise’s commitment to delivering innovative and secure investment solutions, stating, “Our European products integrate seamlessly into professional portfolios while ensuring robust security through offline cold storage with regulated custodians.”

Why European Investors Are Turning to ETPs

Europe has emerged as a fertile ground for crypto investment products, thanks to favorable regulations and high demand from retail and institutional investors.

The Bitwise Physical XRP ETP offers several advantages:

- Accessibility: Listed on Xetra, Europe’s most liquid ETF trading platform, the ETP is accessible to retail and institutional investors alike.

- Security: Assets are held in cold storage by regulated custodians, ensuring a high level of protection.

- Transparency: Investors benefit from a redemption feature, providing confidence in the product’s underlying value.

These features make the ETP an attractive option for those looking to gain exposure to XRP without directly managing cryptocurrency wallets.

Ripple and Bitwise: A Synergistic Partnership

Ripple’s investment in the rebranded XRP ETP highlights a shared vision between the two companies.

- For Ripple: The partnership allows the company to extend XRP’s reach, particularly in the European market, where demand for institutional crypto products is growing.

- For Bitwise: Ripple’s endorsement boosts the credibility of the GXRP product, potentially attracting more investors.

This collaboration exemplifies how blockchain companies and asset managers can work together to advance the adoption of crypto assets.

What Lies Ahead for XRP and Crypto ETPs

With Bitwise’s rebranding and Ripple’s backing, the future looks promising for XRP-focused investment products. Key trends to watch include:

- Increased Institutional Adoption: As regulatory clarity improves, more institutions are expected to add crypto ETPs to their portfolios.

- Diversification of Offerings: Bitwise plans to launch additional crypto ETPs, potentially expanding into staking, DeFi, and other niche markets.

- Global Expansion: Both Ripple and Bitwise are likely to explore new markets, leveraging XRP’s utility and Bitwise’s expertise in asset management.

A Milestone for Crypto Investment

The rebranding of the Bitwise Physical XRP ETP marks an important moment in the evolution of crypto investment products. By combining regulatory compliance, institutional-grade security, and Ripple’s endorsement, the product is well-positioned to meet the needs of a diverse range of investors.

As the demand for crypto-backed investment vehicles grows, initiatives like this are paving the way for broader acceptance of digital assets in traditional finance. Ripple and Bitwise’s partnership could set a new standard for collaboration between blockchain innovators and asset managers, driving the next wave of crypto adoption.